While Section 351 does not impose a strict minimum asset requirement or custodian, we ask that participating portfolios have a minimum value of $1 million and custody at Goldman Sachs, Northern Trust, Altruist, Fidelity/NFS or Schwab. We prefer these custodial systems to facilitate the transfers. However, more custodians may be added in the future.

If you’re unsure if your portfolio will qualify, contact Jack Vogel, PhD. He can be reached at

jack@alphaarchitect.com or schedule a call.

We limit participation to taxable accounts owned by a U.S. person, including individual, joint, or

certain trust accounts. S-Corps or LLCs may qualify, depending on the specifics. Accounts that hold US stocks or ETFs that hold U.S. stocks likely qualify.

Generally, C-Corps are not allowed and are discouraged from participating.

Exchange-traded securities, e.g., stocks and ETFs. For AAUS, we strongly encourage listed U.S. stocks or ETFs that hold U.S. stocks. While smaller, less-liquid issues may be accepted, they can create issues.

If you’re unsure if a security will qualify, contact Jack Vogel, PhD. He can be reached at

jack@alphaarchitect.com or schedule a call.

Ineligible assets include restricted and illiquid securities (e.g., private equity, venture capital, restricted stock), derivatives (options, futures, swaps), cryptocurrencies, and physical commodities. Additionally, ETFs that are not structured as RICs, such as commodity pools, grantor trusts (e.g., GLD), and partnerships, are generally ineligible.

Section 351 allows a company to restructure into a newly formed corporation, e.g., a newly-created ETF. Provided specific tests are met, shareholders may transfer ownership from one entity to another without recognizing gains at the time of transfer.

No. Section 351 has been part of the Internal Revenue Code (“IRC”) since 1954.

Before Section 351, transferring business assets to a corporation in exchange for shares of a newly formed corporate stock triggered capital gains taxes on any appreciated assets. Congress recognized that imposing capital gains for such a transfer did not create any real economic gains, as the owner was merely changing the structure, not exiting, the business.

So, to make it easier for these business owners to expand to a corporate structure and raise

Capital. Congress added Section 351 to the IRC in 1954’s tax code modernization effort.

Yes.

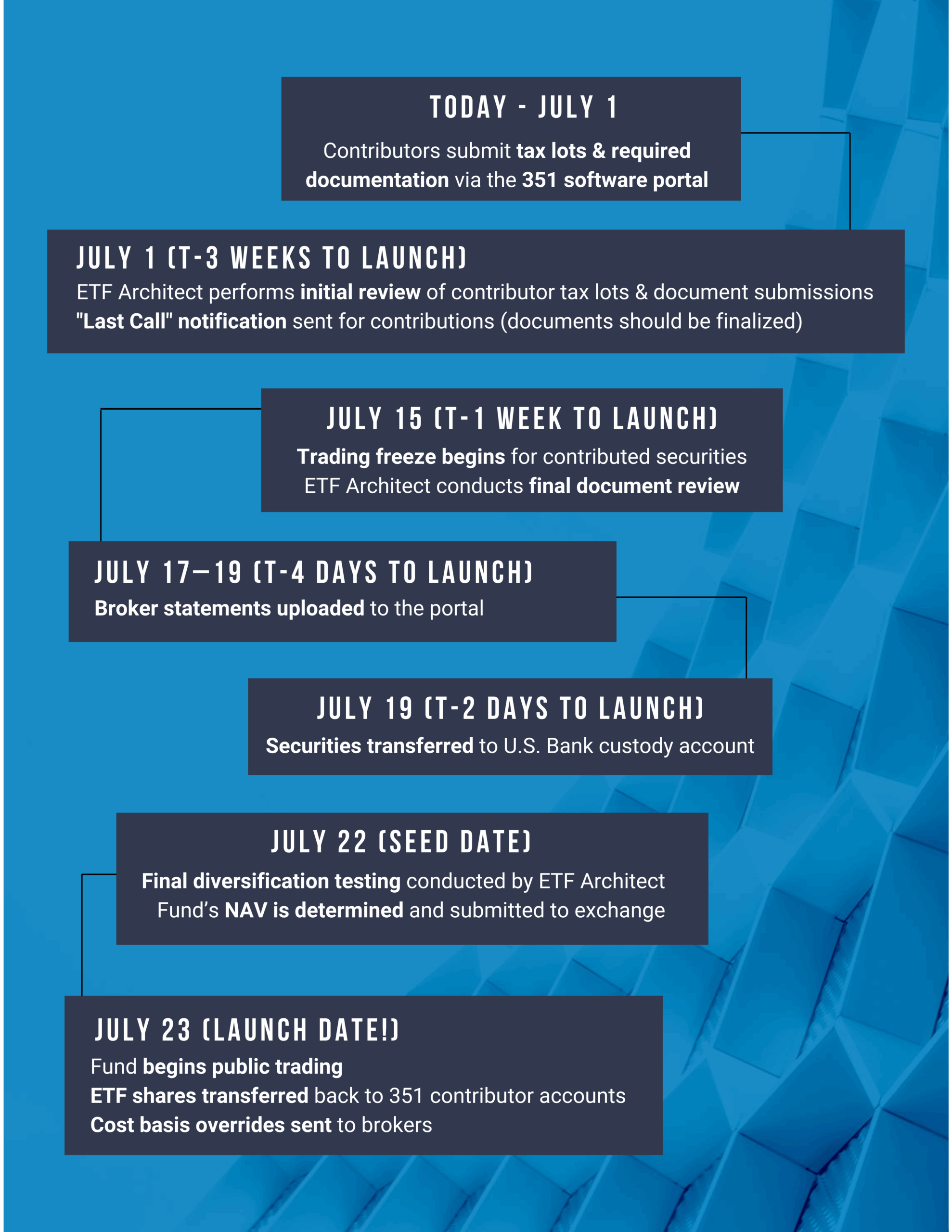

The Exchange will occur on Wednesday, July 23, 2025. It is a one-day event (you can only start a company on one day!).

We ask that all interested parties submit their applications and relevant paperwork on or before

Friday, July 11, 2025.

Ineligible assets include restricted and illiquid securities (e.g., private equity, venture capital, restricted stock), derivatives (options, futures, swaps), cryptocurrencies, and physical commodities. Additionally, ETFs that are not structured as RICs, such as commodity pools, grantor trusts (e.g., GLD), and partnerships, are generally ineligible.

Alpha Architect will bear the administrative costs of facilitating the 351 Exchange. In exchange, we ask for a minimum portfolio size of $1 million and for assets that custody at Goldman Sachs, Northern Trust, Altruist, Fidelity/NFS or Schwab.

A simplified example can illustrate these mechanics without getting too technical.

Suppose a client holds three ETFs – let’s say ETFs A, B, and C. ETF A has two tax lots, ETF B has one tax lot, and ETF C has three tax lots for a total of six tax lots. The combined value of the portfolio is $1,250,000 at a cost basis of $810,000. The investor contributes the three ETFs with six tax lots into the new structure.

In return, they receive the newly formed ETF, AAUS. Critically, the original six tax lots transferred to AAUS are unchanged. The only change is that instead of holding ETFs A, B, and C, the client now holds one ETF – AAUS – with the same tax lot history.

The cost basis and value of positions are retained on a tax-lot-by-tax-lot basis. After conversion into the new ETF, each tax lot maintains its original cost basis and holding period.

The 351 exchange maintains the tax-lot structure, preserving flexibility to select highly appreciated positions for charitable gifting post-conversion.

One key requirement for a 351 Exchange is that the contributed assets must be diversified before the exchange. The IRS applies a 25/50 diversification test, meaning no single security can exceed 25% of the portfolio, and the weights of the top five holdings cannot exceed 50% of the total value.

If one only holds single stock positions, this is a simple calculation. However, ETFs can be used in a 351 Exchange, and that calculation can become a little more onerous.

One example would be 30% of a portfolio invested in a US large-cap ETF. While this would seem to exceed the 25% threshold and disqualify the portfolio from participating in a 351 Exchange, it does not. Fortunately, ETFs are evaluated on a “look-through” basis for diversification testing. Meaning, the weights of the stocks within the ETF is considered for the 25/50 test rather than evaluating the weight of the ETF holding. In this example, let’s say Apple has a 7% weight in the ETF. From a portfolio perspective, the ETF would be contributing 7%*30% = 2.1% of Apple into the 351 Exchange. We would add any other Apple positions, directly or indirectly (such as through other ETFs), to get the final Apple position weight for the 25/50 diversification tests.

AAUS’s return and portfolio composition will generally resemble a Large-Cap strategy. AAUS also includes a strategic dividend management feature. At times, the fund may replace certain holdings about to declare a dividend. In our view, bias towards dividends creates a mispricing opportunity. As a result, AAUS may have lower distributions than peer US market funds.

Gross and net expense ratios are 0.15%. We anticipate that this fee structure will place AAUS in

the cheapest quartile, assuming it is in the US Large Blend category.[1]

[1]AAUS has an effective registration but will not begin trading until approximately 7/1/2025. As of 2/4/2024, there are 1,439 open-end funds in the Large Blend category, including ETFs and all mutual fund share classes. This percentile ranking assumes AAUS will be in the Large Blend category. Categories determined by YCharts.

Alpha Architect is a high-conviction ETF issuer, meaning that we only create and launch a fund if our team believes in the idea. On that point, Alpha Architect has never closed an ETF in our 10+ year history.

We currently manage approximately $7 billion across nine ETFs, split between equities and diversifiers. The investor base is broadly diversified amongst advisors, HNW, and retail

Investors. We do our best to manage business risk, both in our product offering, pricing, and business practices. While we’re biased, we’re confident in our fighting ability to survive the rigors of competing in this highly competitive space. Transparency is one of our core values.

For anyone concerned, we encourage you to contact Jack Vogel, Alpha Architect’s co-CIO, CFO, portfolio manager, and equity partner, with all questions about Alpha Architect. He can be reached at jack@alphaarchitect.com or schedule a call.

In our view, AAUS offers a way to “reset” the portfolio’s exposure back to broadly diversified US Equity exposure by consolidating multiple positions into one ETF. From there, advisors can more effectively align the portfolio to the client’s target risk tolerance, diversify concentration risk, and rebalance with less friction. This makes portfolio management more efficient, flexible, and aligned with long-term financial goals.

We think AAUS offers a way out of the complexity of managing a direct indexing SMA.

Investors can retain their US stock market exposure by consolidating hundreds of individual stock positions into a single, diversified ETF, simplifying position management and significantly reducing administrative complexity.

Section 351 requires that the portfolio must be diversified to qualify for tax deferral. Conversely, an Exchange Fund may accept single concentrated equity positions.

A 351 Exchange into a newly formed ETF converts a diversified portfolio to a newly formed ETF. After the exchange, the ETF may be transacted like any other ETF, including intraday liquidity.

Conversely, Exchange Funds typically have a seven-year lock-up and other liquidity restrictions.

While Section 351 does not impose a strict minimum asset requirement or custodian, we ask that participating portfolios have a minimum value of $1 million and custody at Goldman Sachs, Northern Trust, Altruist, Fidelity/NFS or Schwab.